Comprehending the Basics of Currency Exchange for International Traveling

Browsing money exchange is a fundamental facet of global travel that can considerably influence the general experience. Recognizing just how exchange prices change and where to secure the very best prices is essential for effective budgeting. Acknowledging the possible risks, such as extreme charges and undesirable prices at particular exchange points, can enhance the efficiency of taking care of finances abroad. As travelers plan for their trips, the effects of charge card use and its involved costs warrant careful consideration. What techniques can be employed to make certain a smooth monetary experience while traveling internationally?

Value of Currency Exchange

Currency exchange plays a crucial function in assisting in worldwide travel, enabling vacationers to involve with foreign economies seamlessly. When people visit a different nation, they usually experience a currency that differs from their own, requiring the conversion of funds. This process is essential for buying products, services, and experiences, from eating and shopping to transportation and accommodation.

Understanding the relevance of currency exchange prolongs beyond simple deals; it cultivates a sense of self-confidence amongst vacationers. Having local money enables much easier navigating of a brand-new atmosphere, decreasing reliance on credit rating cards or digital payments that may not always be approved. Furthermore, it urges vacationers to involve themselves in neighborhood society, as they can involve with neighborhood suppliers and explore authentically.

Moreover, currency exchange is necessary for budgeting and financial preparation. Ultimately, money exchange is not simply a monetary requirement; it improves the total traveling experience by promoting social interaction and economic communication.

Exactly How Exchange Rates Work

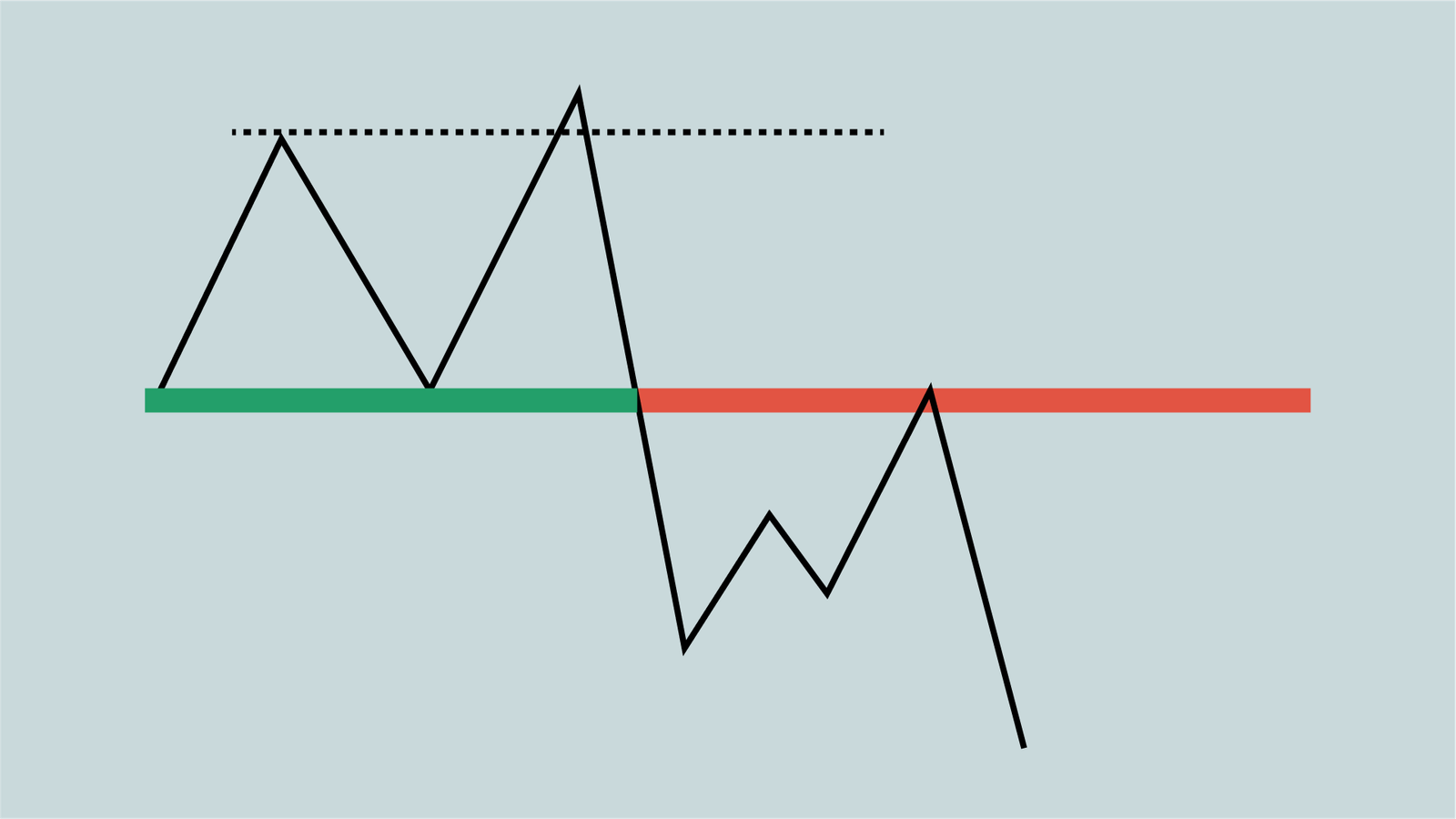

Recognizing just how exchange rates function is necessary for vacationers looking to enhance their funds while abroad. Exchange prices represent the value of one money in connection with another and fluctuate based on different factors, consisting of economic problems, rates of interest, rising cost of living, and geopolitical stability.

When you exchange currency, you are effectively buying one money with one more, and the price at which this occurs can dramatically impact your travel spending plan. Two key sorts of exchange prices exist: dealt with and floating. Taken care of prices are set by governments and continue to be secure, while floating rates fluctuate based upon market need and supply.

Furthermore, the nominal exchange rate is the most typically referenced rate, yet the real exchange rate, which adjusts for inflation, gives a more accurate reflection of purchasing power - forex trading forum. Tourists must likewise be conscious of transaction costs, which can vary amongst exchange solutions and influence the total price of money conversion

Finest Places to Exchange Money

When planning for global travel, choosing the right place to exchange money can dramatically impact your total expenses. Numerous alternatives are readily available, each with its benefits and negative aspects.

Financial institutions are usually a reliable option, as they usually supply affordable currency exchange rate and reduced costs compared to other companies. It is vital to examine whether your financial institution has partnerships with global institutions to facilitate fee-free exchanges abroad.

Currency exchange offices, commonly discovered in flight terminals and traveler locations, supply click for source comfort however might bill greater rates and charges. It is recommended to compare rates amongst different stands prior to making a deal.

ATMs can additionally be a sensible choice, as they typically give neighborhood money at affordable rates. Nonetheless, ensure your home bank does not impose too much withdrawal charges.

Additionally, some credit rating cards supply beneficial currency exchange rate and no foreign purchase charges, making them a wise choice for acquisitions while traveling. Eventually, the most effective area to exchange money will certainly depend upon your certain traveling strategies, the money involved, and your comfort degree with risk. Looking into these choices in advance will certainly assist you make notified choices that will certainly optimize your budget.

Tips for Preventing Fees

Travelers can considerably lower their expenses by utilizing reliable strategies to prevent unneeded charges throughout currency exchange. Among one of the most important actions is to intend in advance and research study exchange prices and charges related to various providers. Using local financial institutions or cooperative YOURURL.com credit union usually produces much better prices contrasted to flight terminals or tourist-centric exchange booths, which commonly bill higher fees.

It is likewise recommended to exchange only the needed amount of currency for immediate requirements, lowering the potential for too much fees on unspent cash money. Lastly, watching on the moment of exchange can be useful; rates can fluctuate daily, so monitoring fads can notify far better timing for exchanges. By implementing these approaches, vacationers can properly prevent unneeded costs and maximize their traveling budget.

Using Credit Report Cards Abroad

Making use of credit rating cards abroad can offer travelers a convenient and safe technique for handling expenditures while lessening the threats related to lugging large amounts of cash money. Numerous credit history cards provide affordable currency exchange rate, frequently extra positive than those offered by currency exchange solutions. Utilizing a credit card can simplify tracking investing, as purchases are automatically taped.

Nonetheless, travelers ought to be conscious of possible international transaction costs, which can accumulate if the card company fees for abroad acquisitions. To reduce these costs, it is a good idea to pick a charge card that does not enforce international purchase costs. In addition, notifying the card issuer of itinerary can help avoid the card from being flagged for questionable task.

When making use of charge card, it is important to make sure that the card is commonly approved in the destination country. Visa and Mastercard are usually a lot more widely acknowledged than American Express or Discover. Finally, preserving a browse around here backup settlement approach, such as a debit card or some money, is sensible in case of technical concerns or areas that do decline cards. By recognizing these variables, vacationers can make best use of the advantages of utilizing credit report cards abroad (forex trading forum).

Verdict